AI

AI

AI

AI

AI

AI

Dell Technologies Inc.’s founder-led business is one of the most remarkable and under-appreciated stories in tech. Dell Technologies is not particularly sexy, nor does it put forth an earth- shattering vision that bends the mind. Yet it’s a company that has consistently figured out how to ride successive waves without becoming driftwood.

And like Hyman Roth of Godfather fame, founder Michael Dell (pictured) always seems to make money for his partners. Unlike Roth, Mr. Dell is not a gangster, rather he’s a gentleman who literally wrote the book on how to play nice and win.

In this Breaking Analysis and ahead of Dell Technologies World 2025 in Las Vegas, we examine the question of how will Dell capture the explosive artificial intelligence opportunity, while transitioning the millions of servers, storage arrays and PCs it already has in the field to this new AI era?

We believe Dell’s ability to stay out in front hinges on three imperatives, including: 1) Doubling down on full-stack “AI factory” systems that collapse infrastructure silos and accelerate time-to-AI value; 2) Unlock the latent power of its massive global channel — treating 200,000-plus partners as an extension of the direct engine rather than a bolt-on; and 3) Modernizing the core — that is, redesigning servers, storage and networking for highly parallel, power-hungry workloads while relentlessly driving down cost per floating-point operation and attacking the energy footprint customers now scrutinize.

Below we show a chart Chief Operating Officer Jeff Clarke unveiled at Dell’s 2023 Financial Analyst Meeting in October 2023.

The image depicts a time-series line that surges through key milestones in tech. We see in the 1990s the direct-to-consumer PC model takes off, then accelerates again in the early internet era when e-commerce turbocharges that same motion. Around the early 2010s the curve flattens — then dips — illustrating Dell’s struggle to morph into an enterprise powerhouse, jettisoning its relationship with EMC and moving forward on its own with 30-plus acquisitions such as Compellent, EqualLogic, Boomi, Perot Systems and many more, including several software assets. This ultimately proved to be an expensive learning exercise. The line rebounds sharply post-2016 after the EMC deal, peaks with the VMware stake, and now turns upward again as Dell positions itself squarely in the AI wave.

In our view the slide is more than a history lesson; it’s a roadmap. Dell’s strategic pivots — private-equity reset, EMC megamerger and VMware monetization — set the stage for the current AI cycle. The task now is to translate that hard-won enterprise footing into end-to-end AI factories, monetized via a revitalized channel and powered by infrastructure that balances performance with energy pragmatism and an enticing value proposition for enterprise customers, relative to hyperscalers.

Dell’s equity story aligns with the market’s awakening to generative AI. The five-year stock chart shown below highlights January 2023 with the shares at around $40 — valued well under one times sales.

Visually, the chart shows a long flat-to-slightly-down channel from 2020 through 2022, a sharp diagonal ascent beginning Q1 ’23, an acceleration post-Analyst Day, and a gentle step-down to the current level — essentially a classic hype-cycle “installed base” plateau.

AI is only half the story, perhaps even less. Dell returns ~80 % of free cash flow to shareholders, Michael Dell included, through repurchases and dividends. That framework resonates with value-oriented funds that previously ignored the name. The flip side, of course, is that sizable buybacks imply management sees limited return on investment in incremental R&D or M&A. Whether that tradeoff is sustainable as AI factories scale will be a key watch-point in upcoming quarters. Dell’s strategy appears to be focus on keeping costs down, making structural changes internally, applying AI to improve efficiencies and driving EBITDA and cash flow through the roof.

As we said, it’s not sexy, but it’s lucrative.

The slide below from Dell’s financial reporting distills the company’s P&L into two main vectors comprising the bulk of its nearly $100 billion in total revenue for fiscal 2025. The business is split almost evenly between its two reporting segments.

In our view, the elegance of this structure is strategic. By preserving the PC volume HP jettisoned after its split, Dell keeps purchase-order muscle that wrings pennies out of every component across the stack. That flywheel lowers unit costs for ISG. Moreover, it allows Dell to claim true “end-to-end” status while competitors assemble piecemeal.

During the early phases of the pandemic, an unprecedented surge in remote-work and at-home learning catalyzed a sharp spike in PC demand. Unit shipments soared, propelling Dell’s top-line revenue to record levels. However, the mix leaned heavily toward lower-margin notebooks. Because these volumes carried thinner product margins and added supply chain costs, the very growth that buoyed revenue simultaneously compressed gross margin, underscoring how a skew toward less profitable products can dilute profitability even in boom times.

Today, the center of gravity has shifted to AI-optimized servers within the Infrastructure Solutions Group. Enterprises and service providers racing to deploy large language model and inference workloads are prioritizing GPU-dense systems with far higher average selling prices and margins. This mix enrichment somewhat offsets Nvidia’s higher silicon vig in each configuration. Consequently, margin expansion is visible despite the absolute dollar outlay for GPUs, illustrating the leverage that premium configurations bring when demand is both urgent and price-insensitive.

Storage mix further accentuates this benefit as Dell controls more of the IP. Looking ahead, we believe the next catalyst will come from a broad-based storage refresh cycle. All-flash arrays shipped in the 2018-2020 window are hitting warranty expiration just as new AI-centric storage architectures – featuring graphics processing unit-direct fabrics, parallel file systems, object stores and greater AI affinity, combined with ultra-low-latency networking embedded into servers — enter mainstream availability.

As customers migrate to these higher-value, high-capacity systems, the shift promises a second-order margin tailwind. In our view, the combination of richer storage average selling prices and recurring software licensing tied to data-services will fortify gross margin even further, extending the profitability uplift that began with today’s AI-server boom.

VMware hitting Dell’s P&L once addressed Dell’s software deficiency, but the Broadcom divestiture leaves a hardware-centric portfolio. Management chose liquidity and balance-sheet clarity over folding VMware in and inflating margin optics. The explicit bet Dell is making in our view is that its supply chain scale combined with AI factories will allow the company to compete on value against the likes of Hewlett Packard Enterprise Co. and Amazon Web Services Inc.

In our opinion, Dell’s ~$100 billion hardware flywheel is both its moat and its challenge. Though the company has unmatched procurement leverage on one hand, it faces constant pressure to innovate at wafer-thin PC margins while chasing higher-value enterprise workloads. As much as we would have loved to see a VMware “spin in,” the company appears comfortable with and well-suited to pursue its current model and navigate the challenge.

Above we show a comparative table of five tech incumbents — Dell, HPE, IBM Corp., Cisco Systems Inc. and Oracle Corp. — arrayed left-to-right starting with Dell, then ascending by revenue multiple. The rows list trailing-12-month revenue, gross margin, operating margin, operating cash flow dollars, OCF as a percentage of revenue, approximate market cap as of yesterday, and the resulting revenue multiple.

In our opinion, Dell’s capital-return story and AI server uptick have closed part of the valuation gap, but the table tells a clear story – i.e. hardware scale alone makes it difficult to crack the 1x sales valuation ceiling. To earn a software-style multiple, Dell must: 1) Embed higher-margin intellectual property deeper into its AI factory stack; 2) Find a software engine it can keep this time; or 3) Massively automate with AI, cutting internal costs and driving unprecedented productivity by applying agents to redesign processes.

We believe the third option carries low risk and is well underway. This in and of itself should provide a mid-term valuation boost. It remains unclear whether Dell will tap either or both of the other two options to trade at a higher multiple relative to peers.

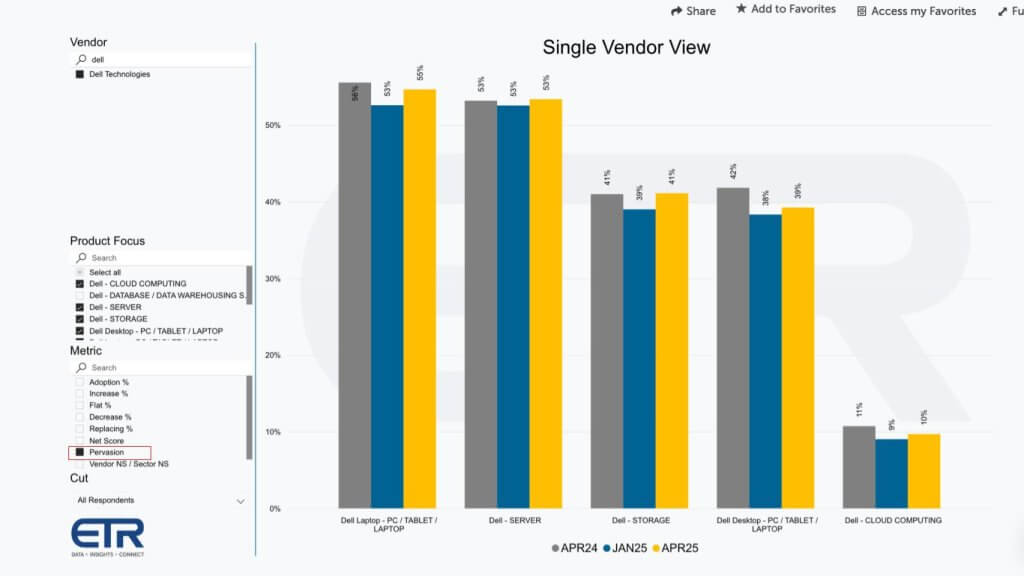

The slide below pulls from Enterprise Technology Research’s quarterly TSIS survey and plots Net Score — the firm’s composite metric for spending velocity — across five Dell categories: Laptops, Cloud Computing (read: private-cloud spend), Storage, Servers and Desktops. Three data points appear for each line — April ’24, January ’25 and April ’25 — letting us track budget sentiment over the past year.

How to read the graphic

Key observations

We believe the survey reinforces Dell’s mixed reality. That is to say, macro belt-tightening is tamping down momentum, yet the PC franchise still outperforms and the private-cloud narrative resonates with a smaller but meaningful subset of buyers. The net effect is muted, not collapsing, which sets the stage for an AI-driven refresh cycle to re-accelerate infrastructure spend when and if budgets loosen.

The slide below takes the same ETR dataset but switches the y-axis from Net Score to Pervasion — the percentage of survey respondents that cite Dell as a current supplier in each category. A red box highlights the metric and the bars immediately show how deeply embedded Dell is across the enterprise landscape, with the exception of cloud.

Visually, the bars for laptops and servers extend above the 50% line, storage and desktops cluster just below 40%, and cloud computing trails in the low teens.

What the numbers tell us

We believe these pervasion stats highlight Dell’s greatest strategic asset – that is, a vast, sticky installed base it can mine for AI-factory upgrades and cross-portfolio pull-through. The challenge — and opportunity — is converting that legacy footprint into next-gen infrastructure before subscription-heavy rivals poach the refresh cycles.

The next slide below is a two-axis scatter plot drawn from the same ETR dataset:

A dashed horizontal line at 40% highlights the “elevated-momentum” threshold; no hardware vendor breaches that bar in this cut, underscoring the budget drag we discussed earlier and the maturity of this market.

Our research indicates that Dell’s commercial laptop line enjoys best-in-class velocity and the broadest footprint, a combination rarely achieved in mature categories. That leadership not only sustains the company’s supply-chain economy of scale but also gives Dell a privileged entry point to upsell edge AI workflows and back-end infrastructure as customers modernize their fleets.

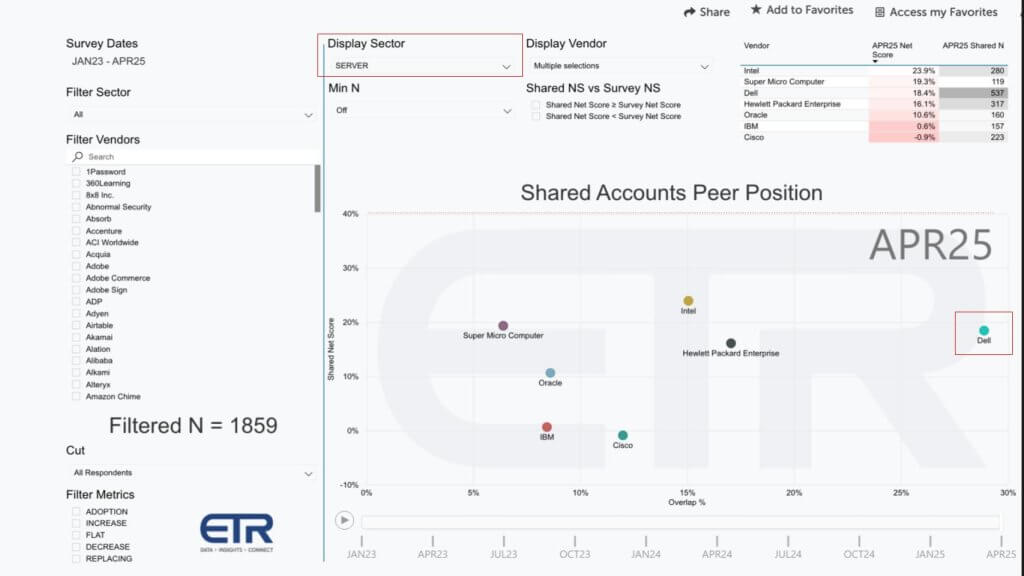

The data below is another ETR scatter plot — Shared Net Score on the vertical axis, Penetration (Overlap) on the horizontal — this time comparing server vendors. The dashed red line at 40% again marks the “high-momentum” threshold.

The slide below shows the ETR storage scatter, again plotting Shared Net Score (spending momentum) on the vertical axis and Penetration (Overlap) on the horizontal. Remember, ETR lumps primary storage and data-protection arrays into one category, so the field mixes old-guard storage area network vendors with next-gen and legacy backup platforms.

In our view, Dell’s strategy is clear: Leverage its unparalleled storage footprint to seed AI-ready infrastructure upgrades, continue to update the portfolio with AI optimized storage (parallel file systems, high performance, disaggregated systems); and then rely on tight partnerships and full-stack integration to reignite the momentum currently captured by more specialized rivals.

Our research indicates AI is not merely an incremental workload; it is redefining the entire data-center stack. The graphic below is our April 2025 update to the long-range data-center infrastructure forecast covering facilities, power, cooling, servers, storage and networking.

A key marker highlights total spend topping $1 trillion in the early 2030s.

In our view, the takeaway is stark – that is, every dollar of traditional x86 spend that flatlines must be replaced, or exceeded, by GPU-dense architectures. Suppliers that master power, cooling and supply-chain economics for AI factories will ride this trillion-dollar wave; those clinging to CPU-only designs risk shrinking into the gray band that barely registers on the forecast by decade’s end. IBM’s Z will survive this transition and x86 will continue to have its place, but the days of dominance for general-purpose architectures are over.

The chart below strips out non-AI workloads and isolates annual AI infrastructure outlays through 2035. Two stacked areas tell the story:

Note: overall AI infrastructure surpassing the trillion-dollar mark early next decade.

We believe Dell is engineering squarely for the AI crossover:

In our opinion, hyperscalers will continue to set the early pace, but the battleground for the next decade is enterprise AI. Dell’s strategy — “modernize what you have while layering in what you need for AI” — positions the company to capture that second-wave demand when the forecast says on-prem AI spend overtakes legacy infrastructure.

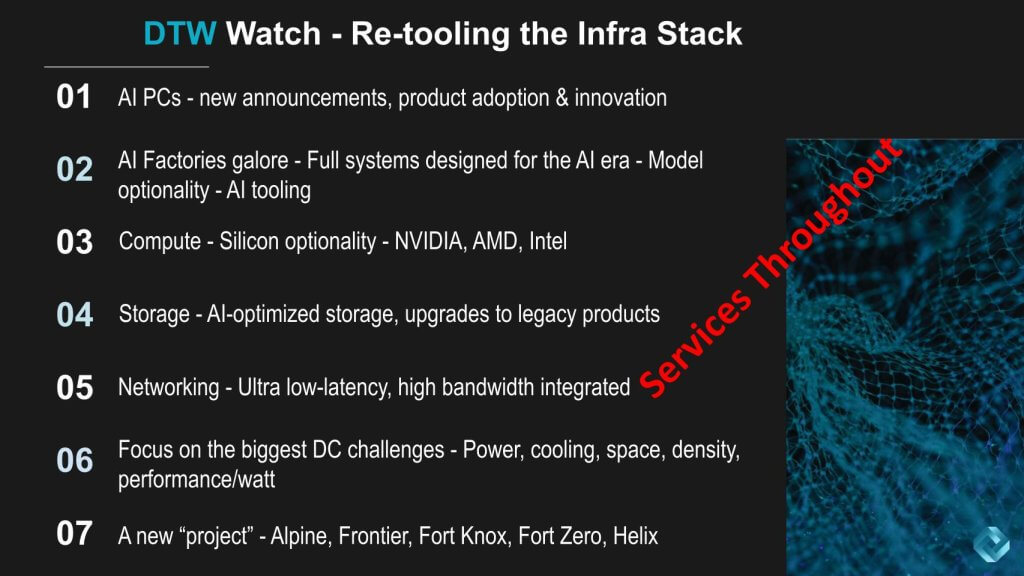

We expect Dell to emphasize heavy dose of AI PC messaging — hopefully some new adoption metrics, refreshed form factors and a deeper dive on the neural processing unit roadmap. Apple’s early M-series momentum has stoked plenty of chatter around on-device inference; Dell must now prove its AI-chip-plus-NPU strategy can deliver comparable battery life, latency and developer traction.

Expect Dell to bombard attendees with server, storage, and “AI factory” SKUs — an options portfolio that illustrates its core value proposition: customer choice at global scale. We believe the headline themes will be:

Dell’s cadence has become predictable: Announce a “Project” one spring, ship the SKU the next. Alpine, Frontier, Fort Knox, Fort Zero, Helix — each followed that pattern. Customers have learned they can scope budgets a year out, but history also shows some projects fade quietly. Caveat emptor: Watch which previous code names and which 2025 “projects” receive firm ship dates versus “tech preview” language.

Dell services has taken on an expanded role in this AI era. Dell recognizes that many customers not only lack an on-prem AI stack but they lack the skills necessary to move fast. Dell Consulting acts as an important accelerant to help customers navigate data quality challenges and governance and privacy concerns; and build solutions that can fit into existing legacy infrastructure while at the same time helping firms lean into the AI opportunity.

Expect services and consulting to be prominently on display at DTW 2025 from laptops to the top of the stack and into managed services.

Our analysis flags four areas that could challenge Dell’s AI ambitions:

In our view Dell’s differentiation will not come from boasting the fastest GPU node — everyone will hit spec-sheet parity within quarters. The real test is whether Dell can orchestrate an end-to-end AI factory that stitches racks, storage, fabrics, software and services into a turnkey outcome, then deliver it through a channel that already owns the loading-dock badge at most enterprises.

If Dell executes, it can harvest the cash flows of its mature PC and server franchises while expanding wallet share with AI-ready systems for the next decade. The pivot hinges on the following key question: Can those AI factories leap from Tier-2 and Tier-3 service providers into mainstream enterprise halls before cloud vendors lock in the market?

We’ll be on the ground with theCUBE all week to test that thesis—and will report back in Breaking Analysis as the story unfolds.

THANK YOU